The research was produced by collecting questionnaires from casino operators, slot producers, gaming publications, aggregators, regulators, etc. Data was collected from C-level executives or business founders. No distinction as to the size of business or geography of operations were made.

Publication of results will, presumably, be done in 10 parts, each of which will be dedicated to discussing a particular group of questions and contain opinions of 5-7 distinct companies.

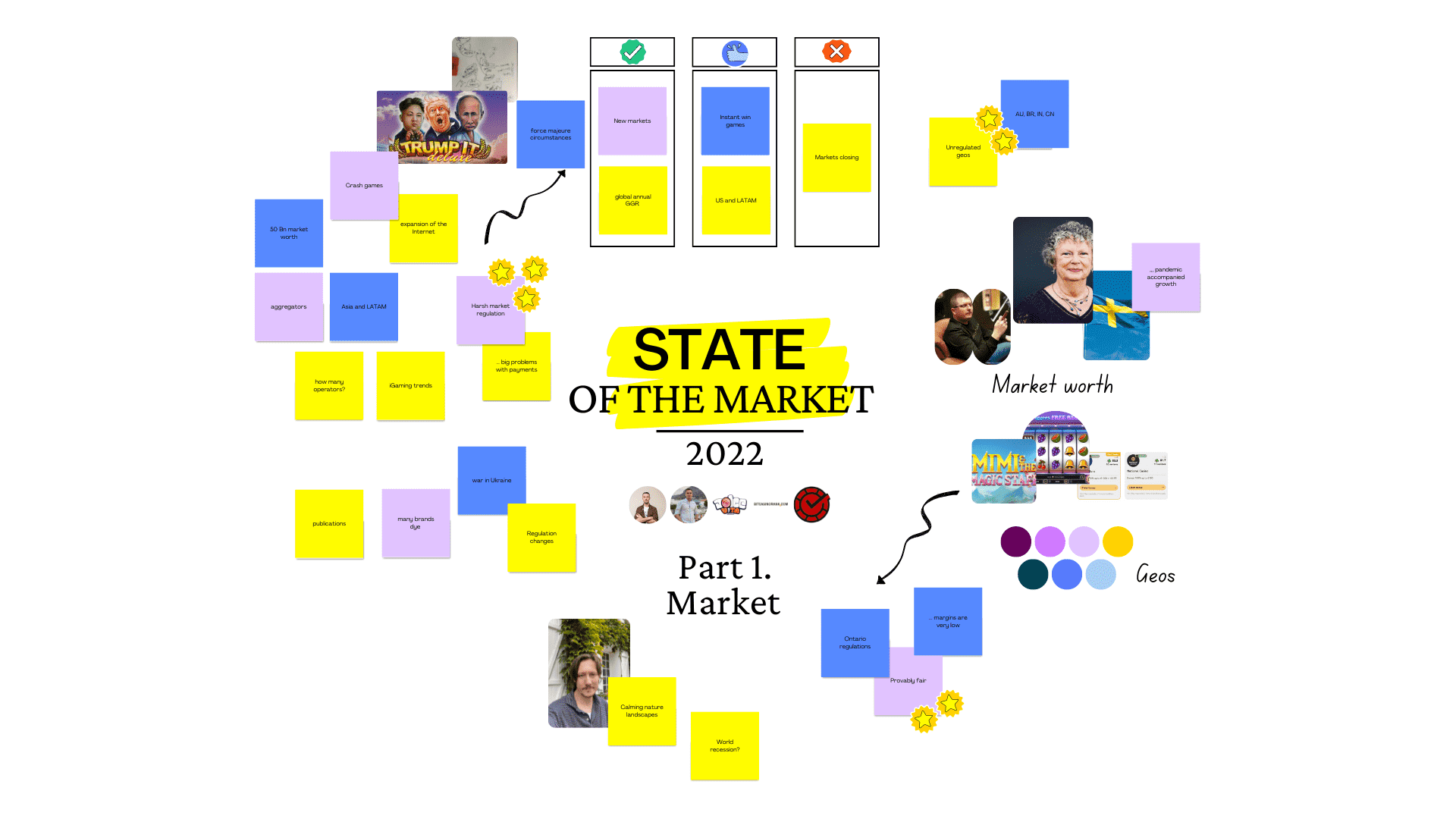

Part 1. Market

In this section we attempted to discuss the market worth, the market composition in terms of the classical and crypto currency casinos, market dynamics as well as highlight possible trends and opportunities for the coming 5 years.

Participants cited:

- Correctcasinos (igaming publisher)

- Dolcevita casino (casino operator)

- Bitsler (crypto-gambling operator)

- Bitfiring.com (casino operator)

- Bitcasinorank (crypto-gambling publisher)

- G Partners

- Gamzix (games developer)

Questions asked:

- In your opinion, what is the global online casino market worth and the most popular geos?

- Which geos are the most cost effective in terms of market size, player value, competition, etc?

- From what you know, what might the number of active brands out there in total?

- What is the share of crypto currency casinos (CCC) in the market?

- How do you think, how many new brands are coming up / dying each year?

- What do you think is the online casino market potential in 5 year time?

- What are the latest online casino market trends?

- What do you think are the next big geos to start a casino?

1.1.

In your opinion, what is the global online casino market worth and the most popular geos?

The estimates of a turnover of global casino gaming markets would obviously differ, moreover, they would differ even more depending on the definition of the 'global' market. Notably, igaming publications have a more vague sense of the market worth, while software providers and operators would tend to use some numbers that they probably anchored by.

Gamzix's CEO Aleksandr Kosogov says:

In my opinion, the global annual GGR is about 600 billion EUR. Most profitable are UK, US markets.

Likewise, the boundaries of the seizable casino gaming market are moving in the sense that some tend to glare into the 'black' (in the sense of wild, prohibited).

Inna Gagarin, co-founder of G Partners would add that:

" I believe that the entire world market ... cannot be counted, due to the fact that the richest markets are 'black'.

But I believe that this market is measured in tens of billions of dollars, but rather even hundreds of billions of dollars a year.

Others would pertain to the market overview reported by authorities or commentators:

[...] the overall market of online gambling was over $60 billion in 2021 and is expected to grow in 2022 due to a growing tendency over the next ten years.

"Undoubtedly, the US and LATAM countries are the most popular geos", said Bitsler (crypto casino operator)

1.2.

Which geos are the most cost effective in terms of market size, player value, competition, etc?

When answering the question of the most cost effective markets, respondents has clearly given two different perspectives: some casino operators and publishers would name Nordic markets as well as NZ, Canada and IE, probably due to the players LTV and market history. By the contrast, other including cryptocurrency-only operators and crypto-focused publications - would emphasise the practical implications of attractiveness of "unregulated ones as you don’t need to pay for licence, taxes etc" as Bitsler put it.

G Partners would further develop this idea to point to the

[...] "Black markets. Those who knows how to operate on black markets, such as China in the first place, Australia, Russia, Brazil, India will be effective. For GEO to be successful, there must be a very large country with a large population. And there should be no regulation. If there is regulation, it forces the player to play very limitedly, and makes various limits on the number of spins per second, on the number of bets. Entire lists of gamblers and so on. Of course, all this does not contribute to the development of gambling in the country. Also, do not forget the most profitable one - the US geo ..."

1.3.

From what you know, what might the number of active brands out there in total?

As answers shown, a sense of the competition is always a tricky thing: from 500+ to 50'000 answers would vary.

Bitcasinorank who is a publisherm working with crypto-first operators, said:

"There are around 5000-6000 online casinos. But there could be more because it's hard to evaluate, for example, the Asian market."

Dolcevita casino officials would suggest that there are 22'000-25'000+ operators out there, with which agrees Gamzix saying that:

"Global online casino market is extremely developing, the total number of active brands is about tens of thousands"

1.4.

What is the share of crypto currency casinos (CCC) in the market?

Our respondents would agree that the share of crypto-focused operators is between 2% and 5% of the whole.

Bitcasinorank:

"I did a little research on the number of cryptocurrency casinos, and in 2020 it reached 100, which is a very low market share. Now there are more, but I think the number is under 500"

According to Bitfiring.com opinion:

"This figure, however, may become higher in the future. There was a steady increase in crypto gambling in 2022, and the term bitcoin online casino may take a much more significant role in the online gambling segment. The most likely figure will go up 2-5% in 2023".

1.5.

How do you think, how many new brands are coming up / dying each year?

Respondents would emphasise that, in the end, more operators are starting up than quitting each year. Looking at the numbers, most people would say that it's in thousands.

G Partners: "Thousands come and go. A lot, especially if we talk about gray markets, where there are big problems with payments. Any payment crisis causes most casinos to close. If we are not talking about grey or black markets, but about white markets, then there are big investments - in licences, in development, in marketing.

At the same time, margins are very low. That is why many are closed."

Correctcasinos (publisher that works in UK / SV / NL markets according to Similarweb stats) says that "new brands coming up, probably, about 100 each year. Brands dying, maybe it's 50."

1.6.

What do you think is the online casino market potential in 5 year time?

Talking about the market capacity, operators estimate that it will increase by 30-50% over the period of the coming 5 years.

Gamzix noted:

If we don’t face such force majeure circumstances as quarantine and war, the market could expand by 50% in 5 years due to two factors: the regulation of new markets and the expansion of the Internet in Tier 3.

In Bitsler's opinion it is going to be "Definitely growth" but contrary to Gamzix estimate of pandemic, Bitsler believes that "pandemic accompanied it [growth] strongly". "Even now, when the world recession is predicted due to the inflation that the Ukrainian war has caused, people tend to play more and more"

Dolcevita agrees that market GGR will be up 50%.

Correctcasinos say that the driver of the next five years is going to be the "US if more states are open".

In terms of the next big shift, respondents were not prone to see any drastic paradigm changes anytime soon.

G Partners: "I don't think much will change in 5 years. Gamers will always come offline, they will love expensive VIP rooms, there will always be high-rollers - this will not be canceled. However, both the general middle class and people of lower incomes will play online casinos"

1.7.

What are the latest online casino market trends?

Most of our respondents were naming a rise of crypto gambling, appearing of new markets as well as coming regulation changes as the major trends for the nearest years.

Correctcasinos: "Canada gets more licensed with Ontario regulations, Crypto gambling is growing"

Bitsler:

"Instant games like crash, mines, dice, plinko where you can instantly win big. Another one is a provably fair mechanism that prevents scam and provides transparency to the play"

G Partners noted that the market of Ukraine, Russia, Kazakhstan and other former USSR countries is virtually dead (or will be dead soon) due to the war in Ukraine.

"Eastern markets, if we talk about Indonesia or Thailand, they are not yet ready for such a development of events. They are playing, but if we talk about the trend of 5 years, it is likely that the Far East will play out. This trend will be great. And also China, but China is closed, and only the Chinese themselves operate in China, as it seems to us", say G Partners.

Bitcasinorank highlighted a trend towards the "legalisation of online casinos around the world. Whether it is positive or negative is a debatable question".

And Gamzix expressed the industry's concerns of too stiff regulation.

"I suppose that too harsh market regulation has a bad effect on the industry nowadays. Balance always matters, I believe that more loyal rules will facilitate the development of the industry",

says Gamzix.

1.8.

What do you think are the next big geos to start a casino?

Operators, publishers and developers alike agreed that US, Asia and Latin America will be the drivers of growth of the market.

Gamzix: "I think the next big geos are Asia and Latin America. These are promising market with great opportunities"

Bitsler:

"I would highlight a few from each region: Asia is India, South America is Brazil, Argentina, Chile and Nigeria as for Africa"